How to create a market research survey: The essentials for new researchers

Market research surveys are invaluable tools for businesses to gain insights into trends that are affecting their customers and potential customers, and the challenges they're facing. By gathering and analyzing this data, companies can make informed decisions, tailor their strategies, stay competitive in an ever-changing marketplace, and drive long-term success.

This guide covers the essential steps, common pitfalls to avoid, useful jargon, and practical templates you can use to streamline your market research survey process. You'll also find tips on sampling, pilot testing, and handling open-ended responses effectively. It will help you develop a comprehensive launch plan and identify the key metrics to track, with clear, impactful messaging for communicating with customers and the wider market.

Discover examples of market research surveys, learn how to craft effective questions, and choose the best data collection channels. The goal is to transform your questionnaire into a powerful resource, not just a routine formality.

Let's start with the fundamentals: what is a market research survey, and how is it different from marketing research?

What are market research surveys?

Businesses send market research surveys to customers, leads and other people in their market to gather insights and opinions from a specific target audience about their needs, preferences, behaviors, or perceptions related to products, services, prices, channels, segments, and messaging. They help businesses make informed decisions by collecting valuable data directly from consumers.

Unlike marketing research, which focuses on strategies and methods to promote products or services, market research surveys are concerned with understanding the market and customer base to guide overall business strategies, including product development and pricing – not just marketing strategy.

Why you should use surveys for your market research

Distributing surveys is one of the most common methods of conducting market research. By posting regular online surveys, market researchers can gain an understanding not only of how the market is thinking and feeling about something at a point in time, but also how that changes.

In a market research survey, you can ask closed-ended and open-ended questions to get quantitative data points and qualitative insights on what those data points mean.

The advantages of using surveys in your market research

Surveys provide a scalable and controlled way to gather insights from your targeted audiences. Whether reaching out to customers, clients, leads, or broader groups, market research surveys enable you to capture feedback at the perfect moment.

By leveraging a unified response panel in an online survey tool like Checkbox, you can streamline data processing, visualize information clearly, easily segment audiences, and transform feedback into actionable insights.

The disadvantages of using market research surveys

Market research surveys take time and effort to get right. If you don't spend time preparing your questions and survey structure, you're more likely to confuse respondents and get inaccurate answers.

You also have to be conscious of data security and sensitivity, as well as what information you collect. Responses can also be impacted by the time you send the survey out and the channel you use to send it. If you catch a respondent at the wrong time, you might not get accurate data on how they're actually thinking.

When to use a survey vs. other research methods

First, here's a list of other research methods:

- Focus groups

- Interviews

- Observation studies

- Usability testing

- Social media analysis

- Data analytics and trend analysis

- A/B testing

- Ethnographic research

- Competitive analysis

- Customer feedback reviews

Each one of these methods has its time and place, but the best strategy is to conduct different research methods simultaneously to get different angles on market data.

Of course, each method has its time and place. Market research surveys are most impactful when you want to get fresh data from a large segment and have time to analyze it.

Different market research survey formats

There aren't just different research methods: Once you've chosen to conduct a survey, you have another choice to make. Here are some of the most common market research survey types to choose from:

- Online surveys. Conducting a digital survey provides you with a flexible method for surveying large samples, setting up A/B options, and conducting research at regular cadences. Choose a market research platform that provides customization, security and analysis options to get the best results.

- In-person surveys. Personal surveys include those conducted door to door, in shopping malls, or in B2B meetings. They have all the advantages that face-to-face communication has: the ability to clarify questions on the spot, capture non-verbal cues, and build rapport. However, they can be subject to interviewer bias.

- Phone surveys. These can be conducted by a person or, as is becoming more common, by AI. They're a useful surveying method if you're already in a phone conversation with someone.

- Mail surveys. Mail surveys are often the choice for governments and companies that want to survey a large number of people. They're usually more cost-effective than in-person and phone surveys and allow respondents to answer in their own time. The relative anonymity also encourages honest responses.

You'll possibly already know from this list which type of survey (or even multiple surveys) you need to conduct, but if not, it will likely depend on who exactly you want to survey and the best method to reach them.

How to design a market research survey

Once you’ve decided on the type of survey, it’s time to start building it

To ensure that your survey provides useful data, start with a clear goal. Below is a practical checklist to help you maintain focus, streamline your survey launch and simplify coordination among the research, product, and marketing teams involved.

- Formulate the goal and hypotheses. Your goal identifies the expected effect and metrics, while your hypothesis is what you expect to happen. Example: “Goal: Assess the impact of a 10% discount on the purchase intent of new users. Hypothesis: The 10% discount will make new users more likely to purchase.”

- Describe the audience. Define the target audience: who is included in the survey and what demographic data is needed (e.g., country, age, experience). The audience information will provide you with the basis for audience targeting and further segmentation.

- Build the logic of the questionnaire. Consider the questionnaire structure, which should include an inviting and explanatory introduction, screening questions, main question sections, and demographic questions. Include a few open fields to get qualitative context.

- Prepare the wording. Questions should be neutral, clear, and concise, with only one meaning. Try to have a hypothesis for as many as possible – read the next section for more guidance.

- Choose your tools. For a quick start, use the best online survey tools. Checkbox, for example, offers features like a no-code survey maker, branching logic, high-quality templates, and reports to streamline survey creation.

- Design the survey methodology. Decide on the quotas, duration, and quality metrics (e.g., completion rate) of your survey. Also, map out how you'll process the data efficiently to get the best results and use it to improve business and marketing intelligence.

- Select collection and distribution channels. For regular customer surveys, use email and in-app; for cold audiences, consider social media and panel identification tools in addition to email.

- Consider launching a pilot. Run a series of interviews or push out test surveys – potentially to colleagues not involved in the process – to reveal problematic wording, completion time issues, and logic errors.

- Prepare a report. Build tables, charts, and graphs by segment, with quotes from open fields to build the narrative. Conclusions from this data should lead to action.

- Distribute the report. Send relevant data to each team that will benefit from your insights.

- Identify learnings. What can you improve for your next survey? What do you need to keep the same for consistency and to identify how responses and opinions change?

After completing these steps, verify the conclusions against sales and web analytics to confirm your hypotheses and identify solutions that can be implemented within the current quarter.

The best practices for writing survey questions

Read our article for dozens of market research survey question ideas.

Written out as steps above, creating a survey starts to seem a bit simpler. However, small decisions can make a big difference in the quality of your end product: the data you collect. For example, here are two similar questions that will get very different responses:

- “How would you rate this product on a scale of 1–5, with 1 being very bad to 5 being very good?” (1–5 scale)

- “How satisfied are you with this product?” (Very satisfied, Satisfied, Neutral, Unsatisfied, Very unsatisfied)

Keep your survey design and question writing simple. Avoid ambiguities and don't combine multiple topics in one sentence.

For example, a question like this is likely to confuse respondents and negatively impact the data you gather: “How would you rate this product’s value for money, and how satisfied are you with it?”

Likert, closed-ended questions and number-scaled questions should be consistent in your survey. For example, don't ask respondents to rate something between one and five in the first question, and one and six in the second. Also, don't give the options "Yes", "No" and "Maybe" for one question, and then "Yes", "No" and "Not sure" for the next.

Utilize these types of market research survey questions to get the best results.

- Closed-ended questions with choices to establish things like motivation, barriers, sources of information, e.g., "How did you find out about us? Email, Search, Social media, From a friend or colleague, ChatGPT"

- Likert or numbered scales to understand purchase intent, satisfaction, likelihood to recommend, like: "How satisfied are you with our customer service? Very satisfied, Satisfied, Neutral, Unsatisfied, Very unsatisfied"

- Open-ended questions to get qualitative data, such as: “What would change your mind about buying more often?”

- Multiple-choice questions are great options when you want a range of responses, such as: “Which of the following channels do you use to research new apps?”

The right combination of question types ensures you get the quantitative and qualitative data you need, but don't just use types for the sake of it. Consider what information you want from your market and produce questions that will gather that data.

How to effectively distribute market research surveys

Before you construct your survey, using the right questions as the bricks and sections as the scaffolding, have a think about how you’re going to reach out to respondents.

Communication should be concise and transparent: why you are collecting data, how you're storing the data, how it will help improve the service, and how long the survey will take.

When creating a survey for market research, indicate the benefits for the respondent and how the answers will be used in the first messaging respondents will see.

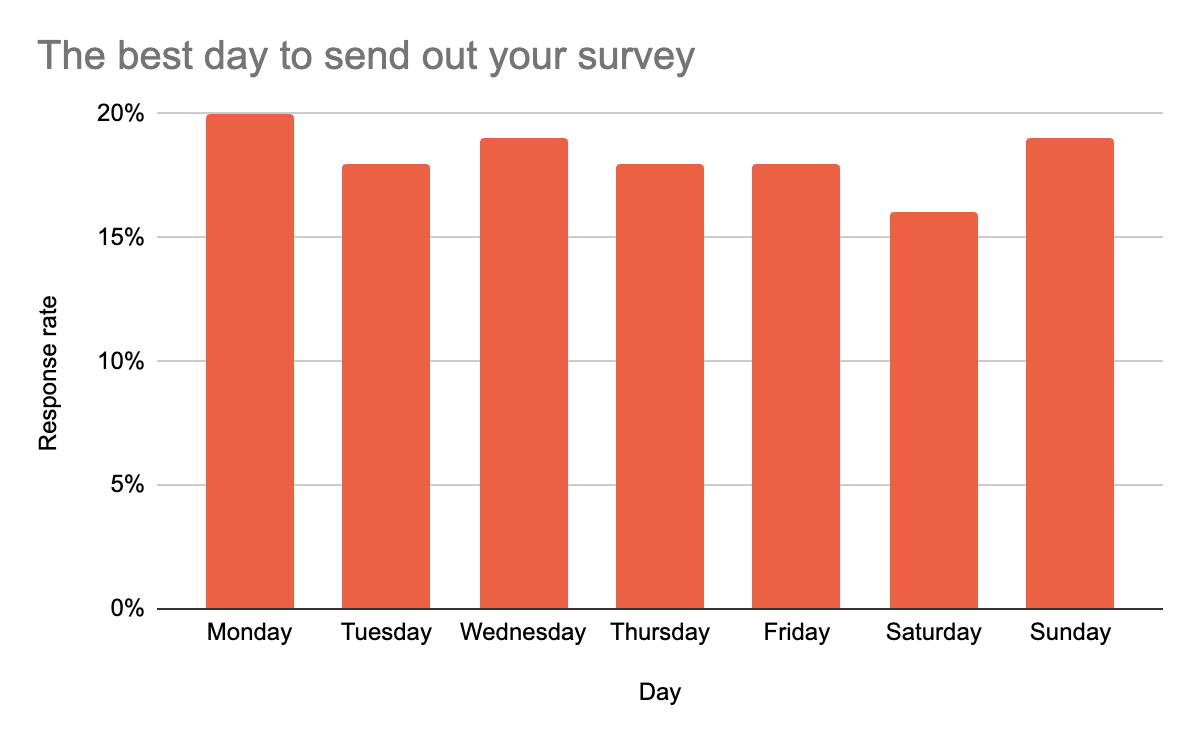

Use personalization if you have the data available and set clear deadlines to ensure you get responses in time. A Zendesk study found that surveys sent on a Monday got the highest response rate, but the rest of the days of the week weren't far behind.

Distribution channels

Your distribution channels are an important consideration. You want enough people to answer your survey, the right people to answer your survey, and your survey quota filled in time.

- Email works well for your existing customer bases and leads

- In-app or in-product is great for new and existing customers, as well as when there's a contextual trigger, such as a user trying a new feature for the first time

- Social networks allow you to target specific persona types and promote your surveys for wide distribution

- Paid panels are useful when coverage and quotas are required

- Website surveys are great at capturing website visitors

The data you want, the people you want to survey, and the survey you build are likely to determine exactly what distribution channels you choose.

If you're unsure, start with your customer base, as it's economical and accurate. For cold audiences, use panels; for websites, use event-driven pop-ups; for apps, use in-app invitations. Small incentives and transparent participation conditions increase sample stability.

Test invitation texts and email subjects, as these factors significantly impact open and click-through rates. In the email, immediately indicate the time frame, goal, deadline, and a “Start” button.

Data confidentiality and security

In your distribution and survey intro messaging, it’s also important to make it clear how you’ll be using data.

Let people know how you store data, who has access to it, and how they can opt out. Anonymization can increase the number of responses, especially when you're asking respondents for their opinion on your product and prices. By following these rules, you will get a cleaner sample and more accurate answers.

Practical advice for beginners: what will help right away

If you’re new to survey creation, and the steps so far seem like too great a challenge, then start small with one goal at a time.

If you have several tasks, consider creating a number of short questionnaires rather than one long one. It's important to maintain a narrative in your survey, as wildly different themes between questions can make answering the survey more challenging for respondents.

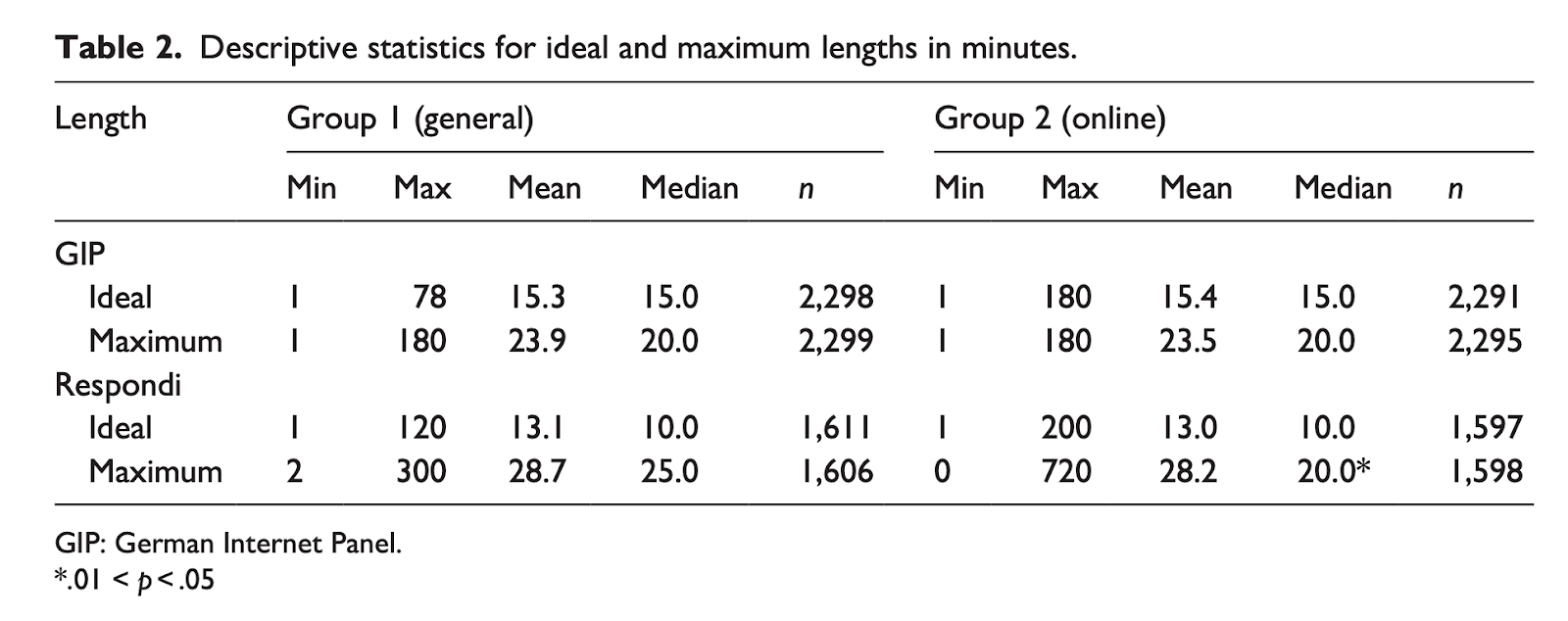

One German study found that respondents believe surveys should take no longer than 20 minutes, but it's advisable to keep the length to 5–10 minutes for customers and up to 15 minutes for a cold audience. In market survey research, this reduces fatigue and increases the accuracy of responses.

Before launching, check your questions and sections against your goal. Remove questions that won't provide you with data that helps you make decisions down the line. Set aside resources for piloting and editing your survey and then agree on how you'll analyze responses with each department – this will give you actionable insights, not just graphs.

Short questionnaire builder example

Here's a basic framework that can be easily inserted into an online market research survey, while leaving room for context. Follow the sequence, from screening to open field, to deliver a set of questions that usually take 5-7 minutes to complete.

- Screening – does the respondent belong to the target audience?

- Experience – when did they last buy, where, why?

- Motivation – what is important in their choice?

- Barriers – what prevents them from buying more often (pain points)?

- Creatives – which ad messaging is clearer?

- Intention – the likelihood of purchasing in the near future.

- Alternatives – Who else is on the list? (Competitor analysis).

- Open field – what to change in the product or service.

This is a compact questionnaire, designed to collect key information, which is easily adaptable to niche audiences and channels.

Common mistakes and how to avoid them

Here are some mistakes to avoid when building your survey:

- Keep it short – long questionnaires kill completion rates, so cut to the chase

- Keep it simple – keep your questions clear and specific to one topic

- Keep it focused – Gather data on one subject at a time to prevent surveys getting too long and complex

- Test your survey – run a pilot or send to the team to make sure everything functions correctly

- Have a hypothesis – predict the results you will get from the survey, but be open to being wrong

Where to start and how to scale your market research survey

To save time, keep a library of survey templates and question examples that establish purchase intent, reason for choosing a channel, barriers, service evaluation, message testing, and price sensitivity. You can then adapt these ready-made market research survey examples for different audiences and campaigns, easily adapting them for online surveys or panel studies.

Maintain a library of data points from previous surveys. These can be used to influence future decisions and as comparison points with data you gather at a later date.

In order to better understand your product's place in the market, you can start to scale your research strategy by adding a competitor analysis block: which brands are being considered, why they are being chosen, and what would turn users to your offer.

Running quarterly brand awareness surveys can help you establish the dynamics of your brand and monitor metrics like consideration, preference, and perception. Start mapping trends to influence the direction your product, marketing, business, and brand take.

Choosing the right market research survey tool

There are plenty of survey tools and agencies available, so deciding on which one is right for you will depend on your business and the survey you want to send out.

However, there are some features that you should always look for:

- Customization options, such as being able to adjust the look and feel of a survey to match your branding.

- Easy-to-use editing tools that don't require you to code your survey

- Integrations with your other tools, either natively or through webhooks and a survey tool REST API

- Great support, ideally human support, to help you make the most of your tool and data gathering efforts.

If you value data security and you need to ensure any information you gather is not at risk, consider your hosting options as well.

As well as having a number of security and permissions features, Checkbox offers an on-premises survey tool deployment option so that you have full control over your data.

How to combine surveys with other data

As mentioned, ensuring your survey tool integrates with other software in your suite is an important consideration.

When combined with web analytics and CRM (customer relationship management) tool data, survey responses can provide valuable insights.

For example, high interest in a pricing plan should be supported by increased purchases of that plan being recorded in your CRM. If not, you have an opportunity to explore the issue and remove a potential obstacle for your users.

Combining data from these tools gives a more complete picture of the target market: who is buying, why they choose your brand, and where your service is falling short – information that will provide you with a basis for narrower audience targeting in performance campaigns and ideas to make impactful product map adjustments.

Conclusion

A well-designed market research survey is a great first step in your product mapping and marketing strategy. You need to set a clear goal, choose the right channels, maintain a clean and concise questionnaire structure, utilize convenient survey tools, and decide on your approach to sampling and fieldwork in advance.

To do this, ask yourself: what exactly are we measuring? Who are we asking? What decisions do we expect? Next comes the pilot, the main survey send-out, data analysis, practical conclusions, and learning implementation.

Create and maintain a library of survey examples, templates and data, filtering by cohort, category and demographic to fully understand the trends and patterns. By following the guidance in this article, surveys will cease to be an ever-changing challenge and become a system that truly guides business decisions.

Market research survey FAQs

A market research survey is a structured questionnaire designed to collect data about your audience, market/industry, product demand, and competitors. It reduces decision risks, tests hypotheses, refines positioning, pricing, and channels, and ensures your investments align with what customers truly need.

Screening, behavioral, motivational, and price sensitivity barrier questions, as well as brand metric and demographic questions, should be included. When it comes to formats, use multiple choice, Likert scales, ranking scales, open-ended and closed-ended fields.

To conduct an effective market research survey decide on your goal and audience, choose a platform, create a survey with question logic/branches, launch a pilot, send out emails and social media posts – or create panels and web pop-ups – to get responses, ensure consent and privacy, track quality, and integrate responses with data from other tools, like your CRM.

The best tools depend on your company, market and the survey you want to create. If you want data security and complete control over the information you gather, choose an on-premises solution, such as the one offered by Checkbox.

Contact us

Fill out this form and our team will respond to connect.

If you are a current Checkbox customer in need of support, please email us at support@checkbox.com for assistance.